Table of Contents

- Key bond market deals: Sundaram Finance, GMR Airports, NLC India

- Chapter Outline The World’s Bond Markets: A Statistical Perspective ...

- What Investors Should Know About Bonds | Investing | US News

- Is The Bond Market Open On Veterans Day 2024 - Kass Sarene

- Economics O’Sullivan Sheffrin Perez - ppt download

- How the Bond Market Works - YouTube

- Bond Market - Meaning, Examples, Types, Pros and Cons

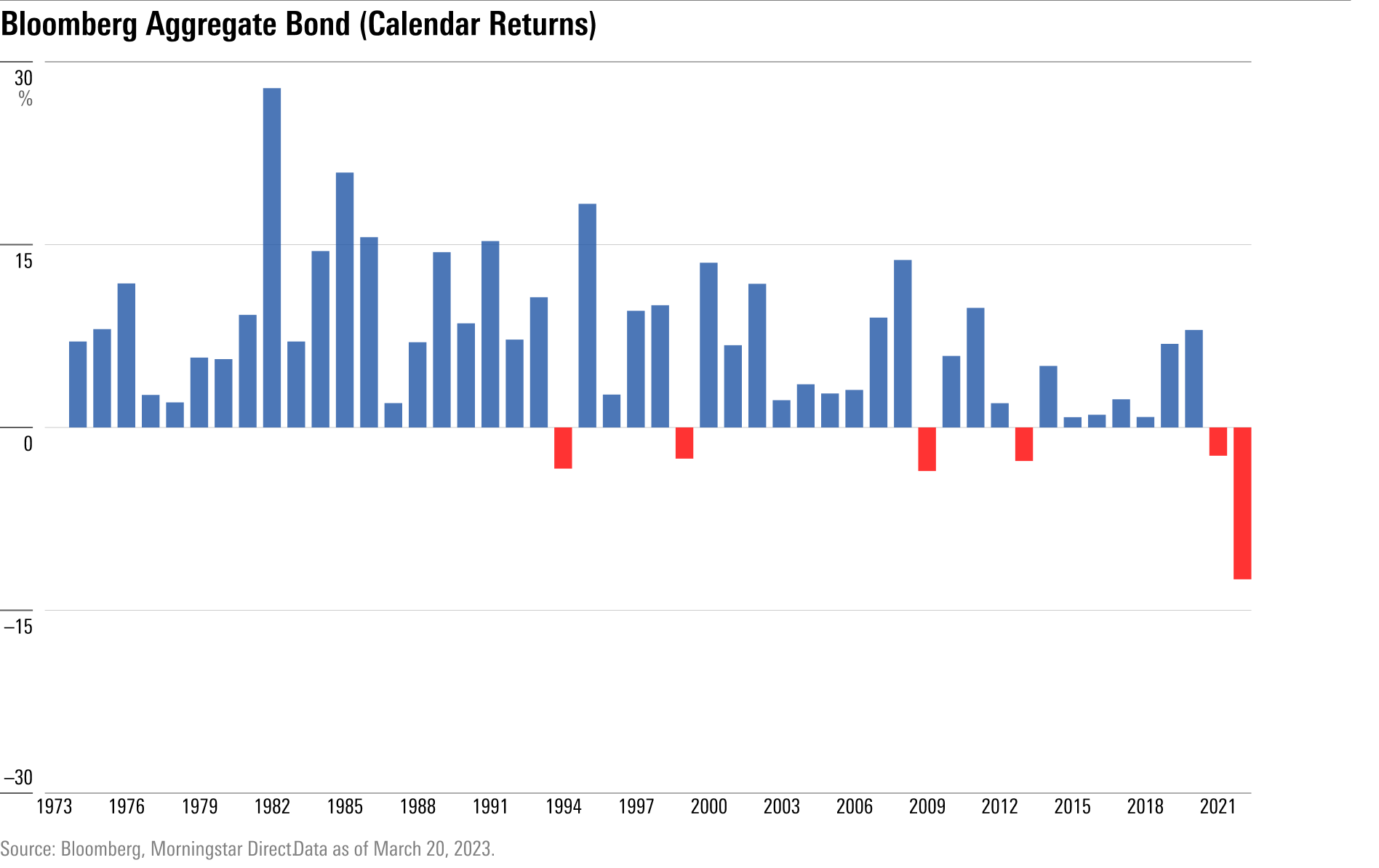

- The Return of the Bond Market | Morningstar

- Bond Market Investment Concept Stock Illustration - Illustration of ...

- Bond Trading May Be Sending a Recession Warning - The New York Times

What are Rates and Bonds?

Bloomberg's Rates and Bonds Platform

Key Features and Tools

Bloomberg's rates and bonds platform offers a range of features and tools that can help investors and financial professionals analyze and track the fixed income market. Some of the key features include: Real-time data: Bloomberg provides real-time data on government and corporate bonds, including prices, yields, and credit spreads. Yield curves: Users can access a range of yield curves, including the US Treasury yield curve, the German Bund yield curve, and the Japanese Government Bond (JGB) yield curve. Credit default swap (CDS) spreads: Bloomberg provides data on CDS spreads, which can be used to assess the credit risk of individual bonds or issuers. Bond screens: Users can create custom bond screens to filter bonds by criteria such as yield, credit rating, and maturity.